In Q3 2017, HMD sold about 21 million phones *Update: CP says 16.3 million*

Update: Counterpoint Research shared their precise data about the sales of Nokia phones during Q3 2017, and the numbers are lower than what I calculated from IDC’s data. My calculation is significantly off, by roughly 20% (a lot) so it’s better to take the precise numbers from a market research company.

Original article:

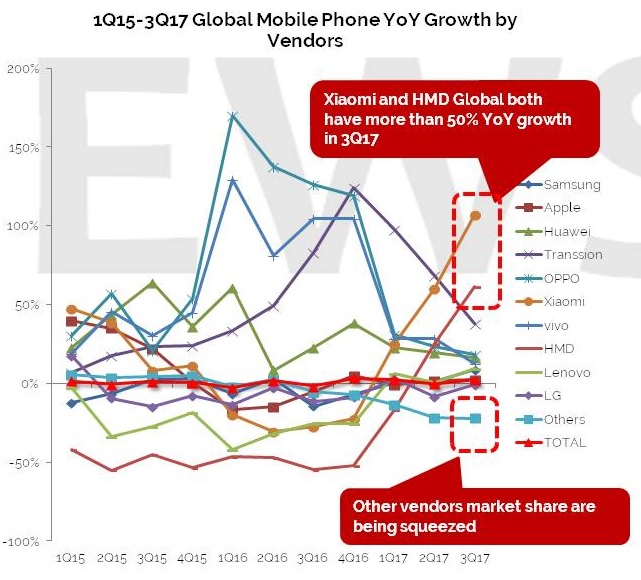

When life gives you lemons, make a lemonade. I did something similar with the data about the phone market IDC published for the third quarter of this year. In a summarizing report, of their “big” report that is accessible to clients, IDC mentions HMD Global and Xiaomi as the fastest growing Top 10 mobile phone vendors, both going above 50% on a year-on-year basis.

The simple report also includes stats for local markets, but HMD is not mentioned apart from the YoY growth segment.

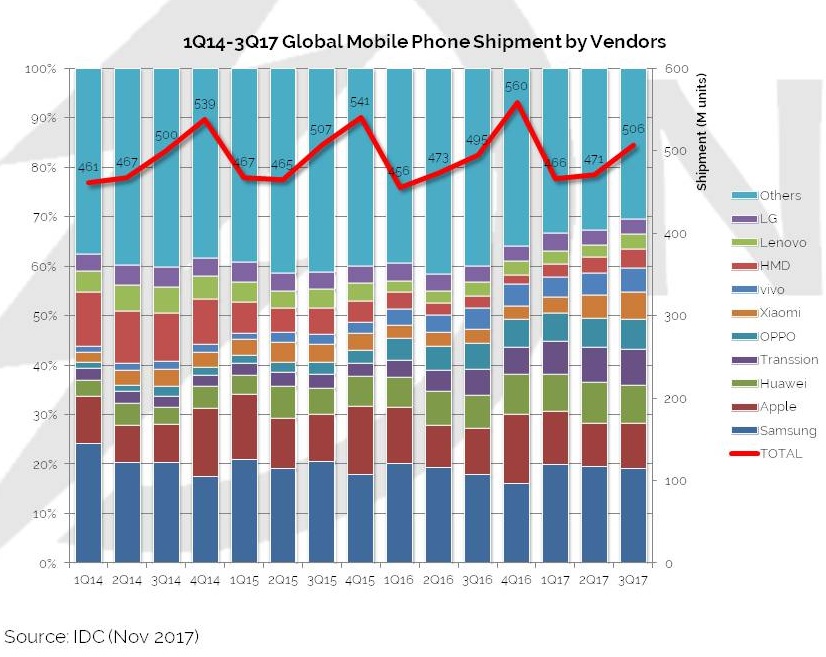

The simple report also includes a chart (above) of the top 10 mobile vendors, where we see HMD on the 8th place. This ranking includes both feature phones and smartphones. The chart doesn’t say that much, apart from Samsung’s slight but constant share shrinking for the last 3 quarters (but that’s seasonally), but it has enough data to roughly calculate how many phones HMD sold during Q3 together with Q2 and Q1 2017. I simply measured the distance between the 300 and 400 (million units) point on the y-axis and the height of HMD’s share. It was done using the ruler tool in Adobe Photoshop (nothing special or scientific), and my guess would be a 0.05 tolerance for the results, meaning it could wary +/-5% from IDC’s calculated, precise data. My calculations go as follows:

Q3 2017: 20.8 million (feature phones + smartphones)

Q2 2017: 14.4 million (13 million feature phones + 1.4 million smartphones [Source: IDC])

Q1 2017: 12.1 million (12 million feature phones + 0.1 million smartphones [Source: IDC])

Total: H1 (Q1 + Q2) 2017: 25 million feature phones

Keep in mind that the above presented numbers are my calculations based on IDC chart, and that could differ from real sales HMD achieved. If we take a look at 2016, Microsoft and HMD then sold 35 million feature phones globally, capturing 8.9% of the market. Samsung was the world’s biggest feature phone vendor with 52.3 million units sold, and this year the situation could change on the top. I was not joking when I mentioned that the chart showed a decline in Samsung’s phone sales (feature phones + smartphones) last 3 quarters, and it could be that HMD is eating a share of the feature phones’ sales there, together with Xiaomi and other Chinese brands pressuring smartphone sales.

In terms of smartphones, we don’t know how much did HMD ship during Q3, but Tomi Ahonen puts his estimate at 3.4 million. If we go along this estimate, that would mean that HMD sold 17.4 million feature phones during Q3, which would be a total (Q1-Q3) of 42.4 million feature phones in the first three quarters. Considering that Q4 is the strongest quarter for phone sales, HMD seems more and more likely to be the new king of feature phones, and winning the battle with Samsung in their first year (if it proves to be so), will be something truly impressive.

If you have any thoughts about this, leave it freely in the comments down below. 🙂