Nokia published Q4 and full year financial report

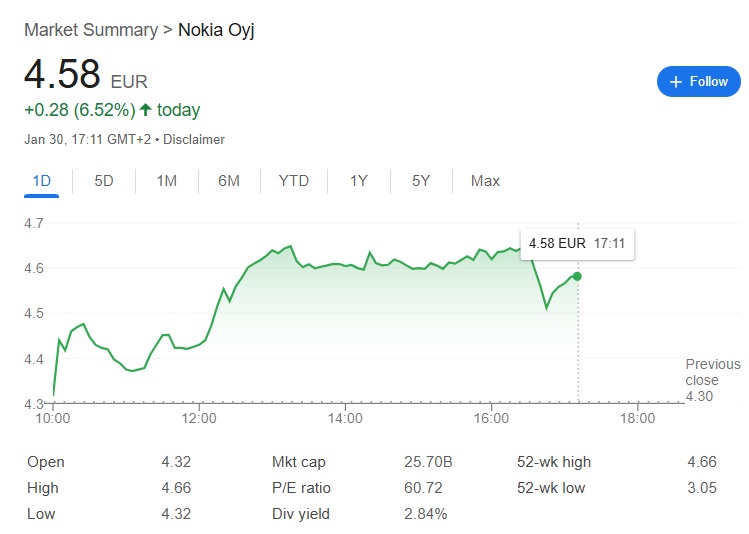

Nokia published its Q4 and full year financial report. The Finns reported strong performance in Q4 2024, with net sales of €6.67 billion, up 10% year-over-year. For the full year, they achieved a 7% increase in net sales, totaling €24.65 billion. The company’s networks and enterprise sectors drove growth, while its operating profit margin improved. Nokia also made significant strides in 5G technology and secured new customer contracts. CEO Pekka Lundmark emphasized the company’s ongoing transformation toward higher-value software and services, alongside a focus on operational efficiency.

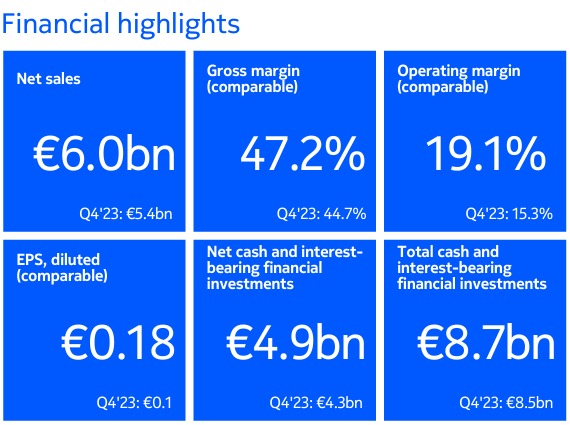

In Q4 2024, Nokia saw a 9% growth in net sales (10% reported), driven by Network Infrastructure and Nokia Technologies. Gross and operating margins improved, reaching 47.2% and 19.1%, respectively. Full-year 2024 results showed a 9% decline in net sales, partly due to India. The Board proposed a EUR 0.14 dividend per share. For 2025, Nokia expects comparable operating profit between EUR 1.9-2.4 billion and free cash flow conversion of 50%-80%.